What will financial services look like in the future? Historically, financial services have been driven by one-on-one relationship-based interactions.

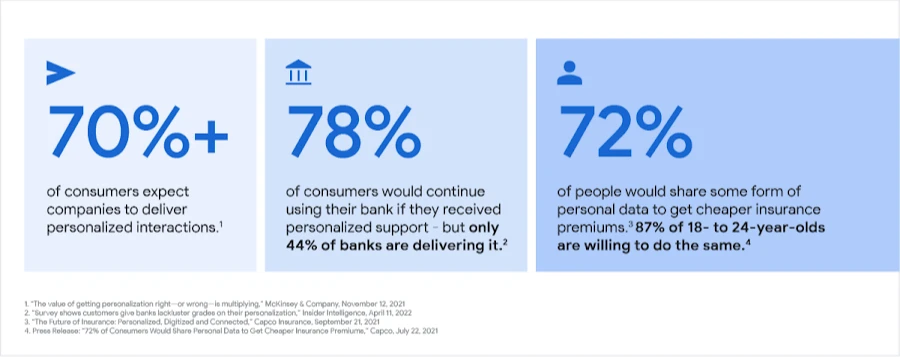

Now, customers expect these trusted relationships to translate into personalized, digital experiences that prove their providers know and value them, and have the capabilities to help them.

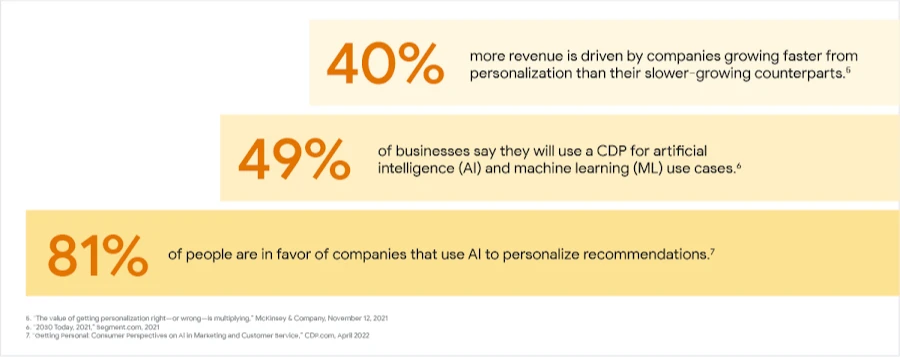

It’s no secret that customer engagement leads to revenue growth. That’s why customer data platforms (CDPs) have gained traction across multiple industries to help businesses analyze, predict, and personalize customer journeys.

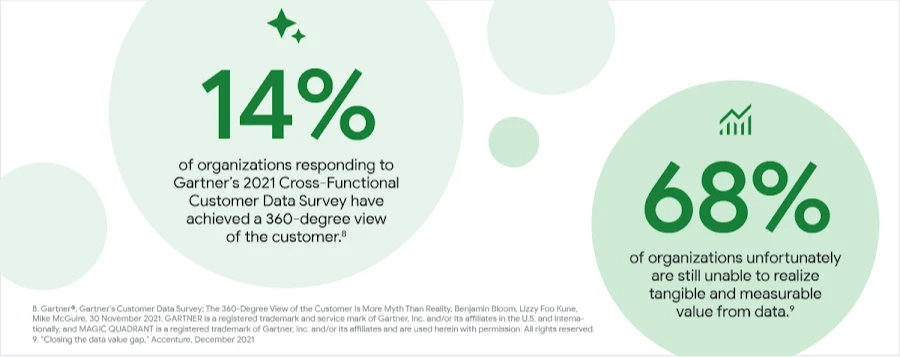

However, a CDP by itself may not be sufficient to gain a holistic view of the customer. Financial services institutions already capture a myriad of customer and marketing data and use many tools to engage their customers. But companies still struggle to unify and analyze all that data across silos and create a holistic view of their customers that’s actionable across different channels and capabilities.

Financial services companies will need to think strategically about maximizing their use of first-party data and analytics to drive better and sustainable business outcomes.

With a true 360 view of the customer, financial services institutions can seamlessly combine all the right data and gain meaningful insights to deliver the type of personalization that really matters to customers.

Google Cloud is here to help