When our founders began Mambu in 2011, their goal was to bring the latest digital technologies to the banking and finance world. Banking, in particular, is an industry built on decades of deep legacy technology. So initially, Mambu was embraced by microfinance — 100 organizations in 26 countries in just the first two years.

Since then, acceptance of modernizing core banking services by using composable, cloud technologies has grown across financial services institutions (FSIs). We now service top-tier banks, fintech startups, and other finance organizations across six continents, helping them deliver flexible, personalized, customer-centric banking products and services that their customers can depend upon.

One of the main reasons we've been able to scale the Mambu composable banking platform across the globe and at our current pace is our partnership with Google Cloud. The decision to move forward with Google Cloud happened for several reasons.

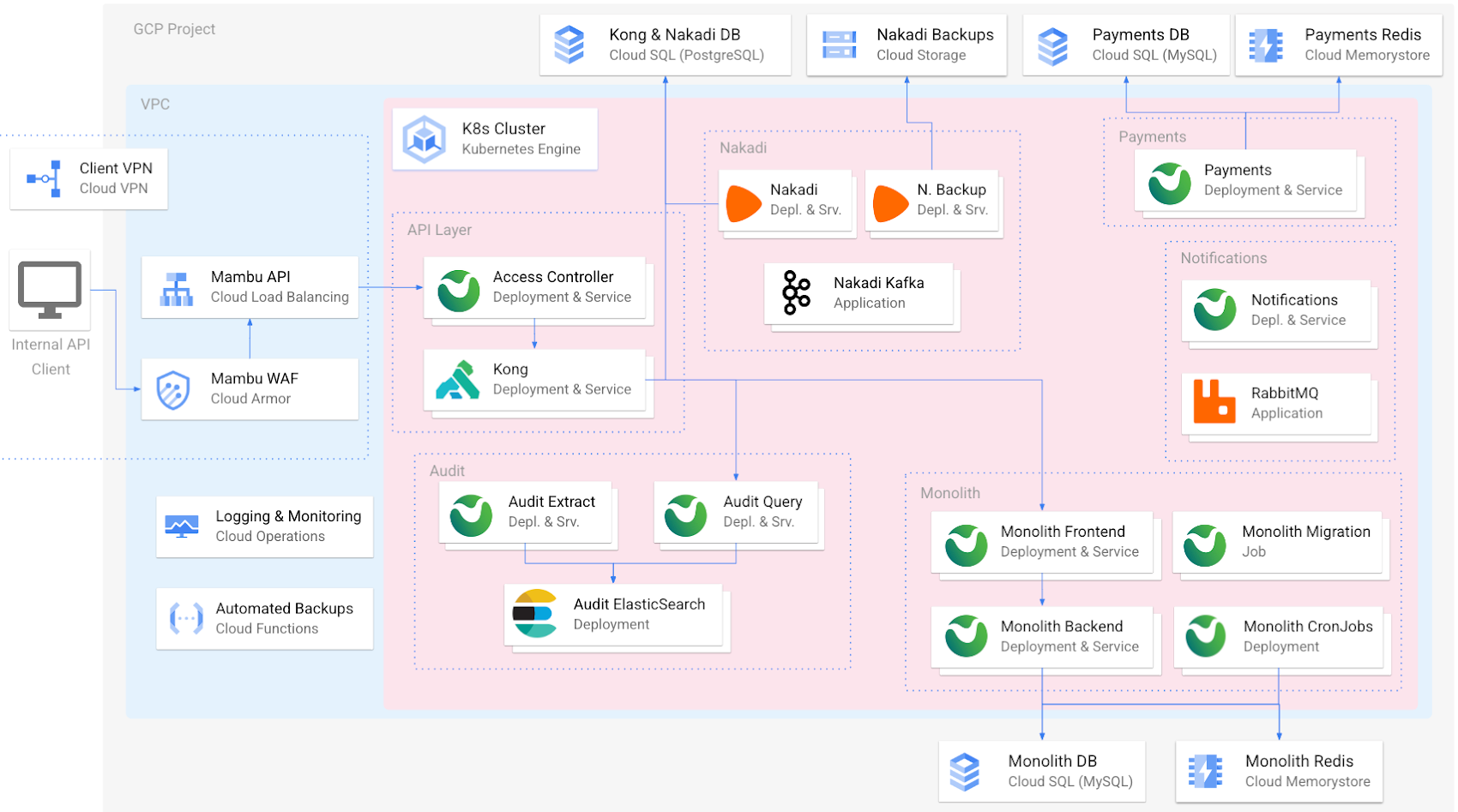

1. Flexibility and openness. Many FSIs are on hybrid and multicloud technology stacks, as they may still be transitioning from legacy systems, or have data residency requirements that have led them to use different clouds in different regions. Mambu meets customers wherever they are in their cloud journeys. We support interoperability without vendor lock-in. This need for openness, as well as the scalability benefits, led Mambu to evolve our platform on Google Kubernetes Engine (GKE). Many customers use open-source Kubernetes because, this common foundation can help streamline integration, speed up time to market, and reduce development. Just as important, the Google Cloud

open cloud approach matches our company values.

2. Security and data residency. For customers in highly regulated finance industries, security isn’t just top of mind, it’s the No. 1 requirement. In addition to Google Cloud's secure infrastructure, external audit certifications, and encryption, its wide array of regions has allowed us to expand into more countries, where we serve banks that must meet local data residency requirements. For example, Google Cloud’s Jakarta Cloud Region, has allowed us to support

Bank Jago in Indonesia as it brings more financial inclusion to the unbanked in that country.

3. Availability. It's critical for banks to maintain basic financial functionality, like accepting deposits and serving cash, even amid a service disruption. We needed a cloud partner with impeccable redundancy, failover, and disaster recovery capabilities.

In addition to GKE, the Mambu platform uses several other Google Cloud services for specific functions, including Cloud Armor, Cloud Load Balancing, Cloud VPN, Cloud Memorystore, and Google Cloud Operations.

In addition to GKE, the Mambu platform uses several other Google Cloud services for specific functions, including Cloud Armor, Cloud Load Balancing, Cloud VPN, Cloud Memorystore, and Google Cloud Operations.