Unicorns: ignore, run, buy, fight?

Unicorns. They look cute. But are they? The answer to that question depends largely on your perspective. As a customer, you might love most of them. Uber, Airbnb, Snap, Didi, and Pinterest make life easier and more fun. SpaceX makes you dream, WeWork realizes the global workspace, N26 and Revolut change our wallet, and so on. From the boardroom perspective of an established corporation, you might be somewhat irritated by these ‘cowboys’. Ignore, run, buy, fight?

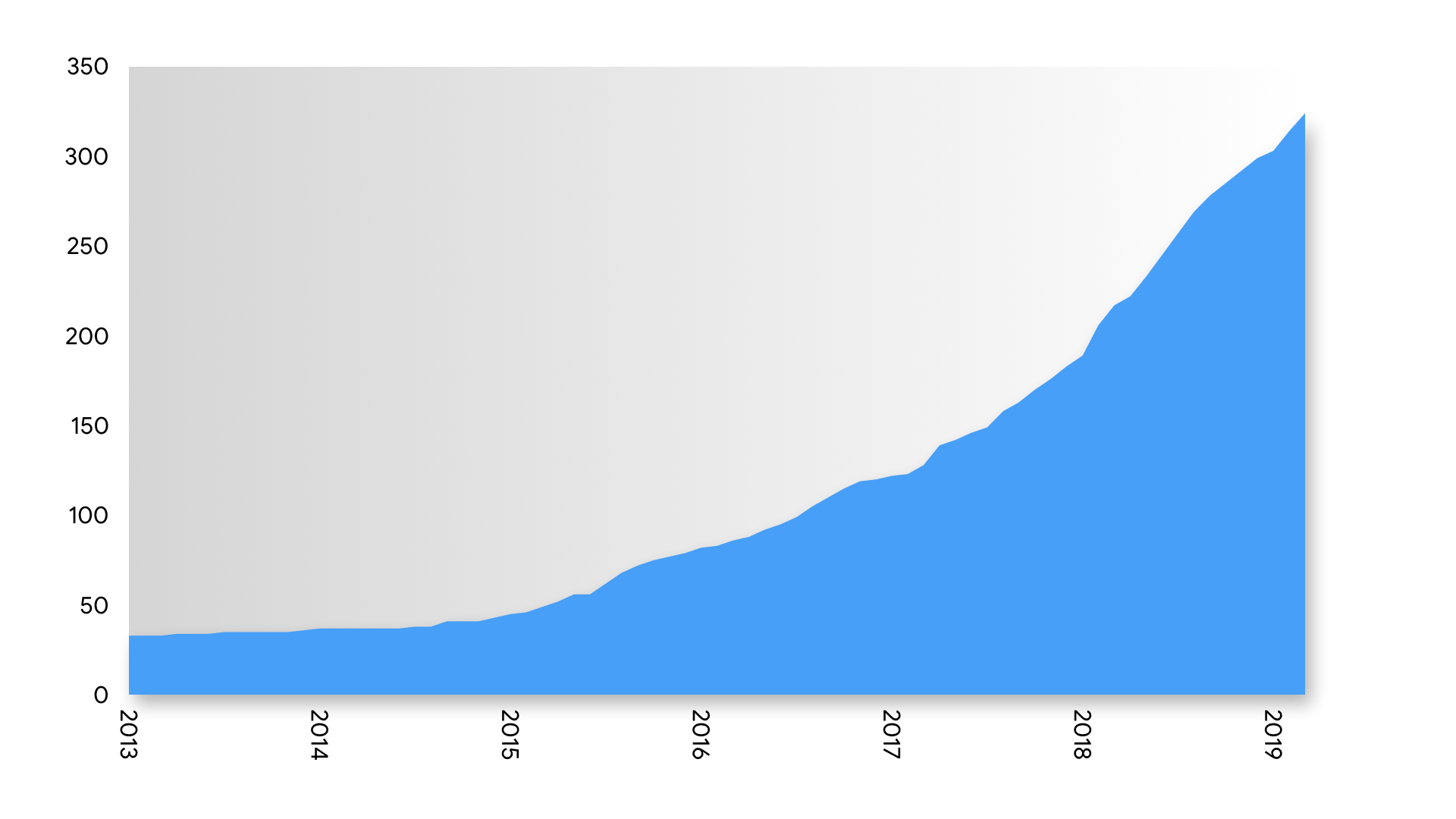

The term ‘unicorn’ was coined in the year 2013 by the founder of the Cowboy Ventures, Aileen Lee, when she referred to the 39 startups that had a valuation of more than $1 billion as unicorns. The term was used to put an emphasis on the rarity of such startups. ‘Rarity’ might not be very adequate anymore, as the number of unicorns is exploding. Today there are approximately 350 unicorns. And that number is rapidly growing:

number of new unicorns over the years

The top ten most valuable unicorns (may 2019) are:

| Company | Valuation $B | Country | Category |

|---|---|---|---|

| Toutiao (Bytedance) | 75 | China | Digital Media /AI |

| Uber | 72 | United States | On-Demand |

| Didi Chuxing | 56 | China | On-Demand |

| WeWork | 47 | United States | Facilities |

| JUUL Labs | 38 | United States | Consumer Electronics |

| Airbnb | 29 | United States | eCommerce/Marketplace |

| Stripe | 23 | United States | FinTech |

| SpaceX | 19 | United States | Other Transportation |

| Epic Games | 15 | United States | Gaming |

| GrabTaxi | 14 | Singapore | On-Demand |

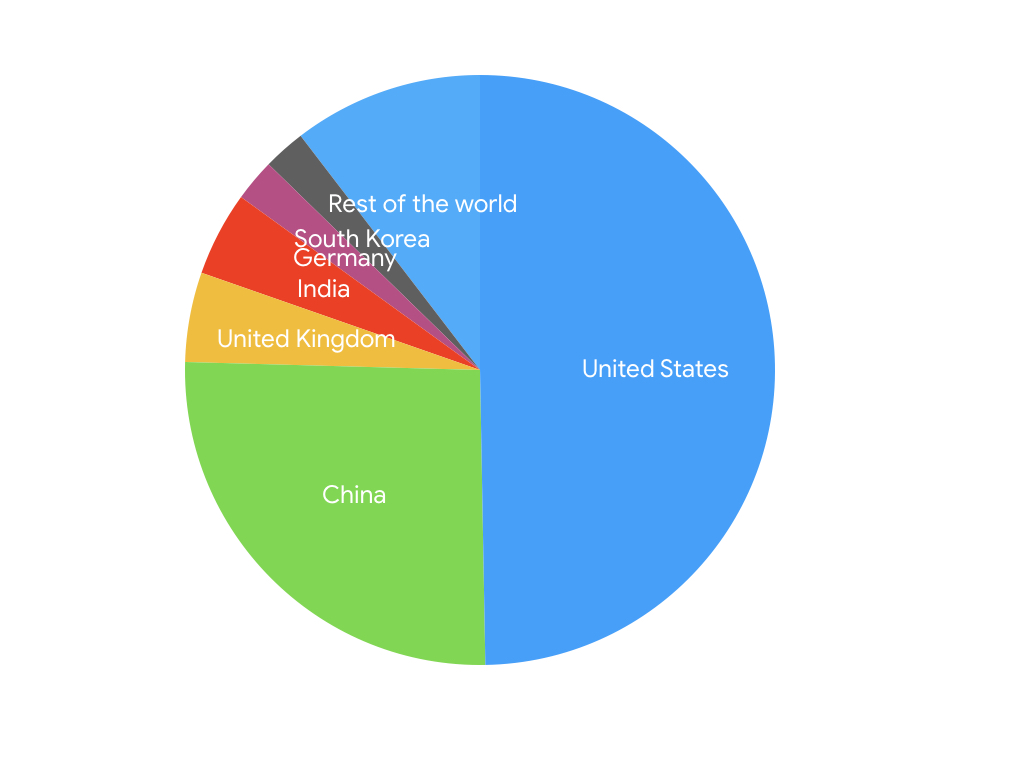

According to CB Insights, the vast majority come from the USA (50%) and China (25%). The EMEA region seems to be lagging behind:

Unicorns are different from other startups, because of four reasons:

- Nearly all of the unicorn startups have disrupted the industry they belong to. Uber changed the way people book cabs, Airbnb capitalized on the sharing economy, Snapchat disrupted the social networking sphere, and so on

- First Mover's Advantage: Disruption and the first mover’s advantage go hand in hand. Unicorns not only capitalize on the first mover’s advantage but maintain their positioning by constantly innovating and improving

- Technology Paradigm Shift Capitalization: 87% of the unicorn products are software, 7% are hardware, and the remaining 6% are other products and services. Almost all of the unicorns until now have capitalized on the market undergoing a technology paradigm shift. Uber brought taxi booking to the tap of a phone, Airbnb made home sharing possible over the internet, Dropbox capitalized on cloud-based technology, and so on

- Consumer Focused: 62% of the unicorns are B2C and their business models are focused on making things easier and more affordable for consumers. Spotify makes it easier to listen to the music of the world, Instacart lets you order groceries at a tap of an app, and so on

As a company, there are roughly three ways to respond to disruption in the market by a unicorn: exit the market, be the disruption, or reshape the market in a way that disruption is less likely to occur.

Sources:

- Why Are So Many Tech Companies Worth Billions? - https://www.youtube.com/watch?v=IS8b5hew3_g

- The Global Unicorn Club - https://www.cbinsights.com/research-unicorn-companies

- Patterns of disruption - https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/technology/deloitte-nl-deloitte-patterns-of-disruption.pdf

- Uber: drivers of disruption - https://www.oxfordmartin.ox.ac.uk/downloads/academic/Uber_Drivers_of_Disruption.pdf